Gaslamp Insurance has access to a new program of insurance designed specifically for Vacant Property and Vacant Land. Some highlights are:

- General liability limits: Up to $1,000,000 per occurrence and $2,000,000 aggregate

- Property coverage: Up to $2,000,000 total insured value at any one location

- Terms: 3, 6, & 12-month terms available

- Buildings: Vacant residential and commercial buildings are eligible, as are buildings under renovation

- Land: Vacant land is eligible

Project-Specific Program

Another new program to help you obtain coverage for those short-term projects, is the Project-Specific program. Some highlights include:

- General liability limits: Limits of $100,000, $300,000, $500,000, and $1,000,000 available

- Target trades: Individual trades working on projects sporadically or as a side-business

- Most Artisan Trades

- General Contractors (remodel of residential & commercial)

- Short-term coverage available: This coverage ranges from a few days to a maximum of 90 days. A one-time extension of 30 days is available to bring the project maximum to 120 days. If you need a longer term, your Gaslamp Agent has access to other programs to handle that as well

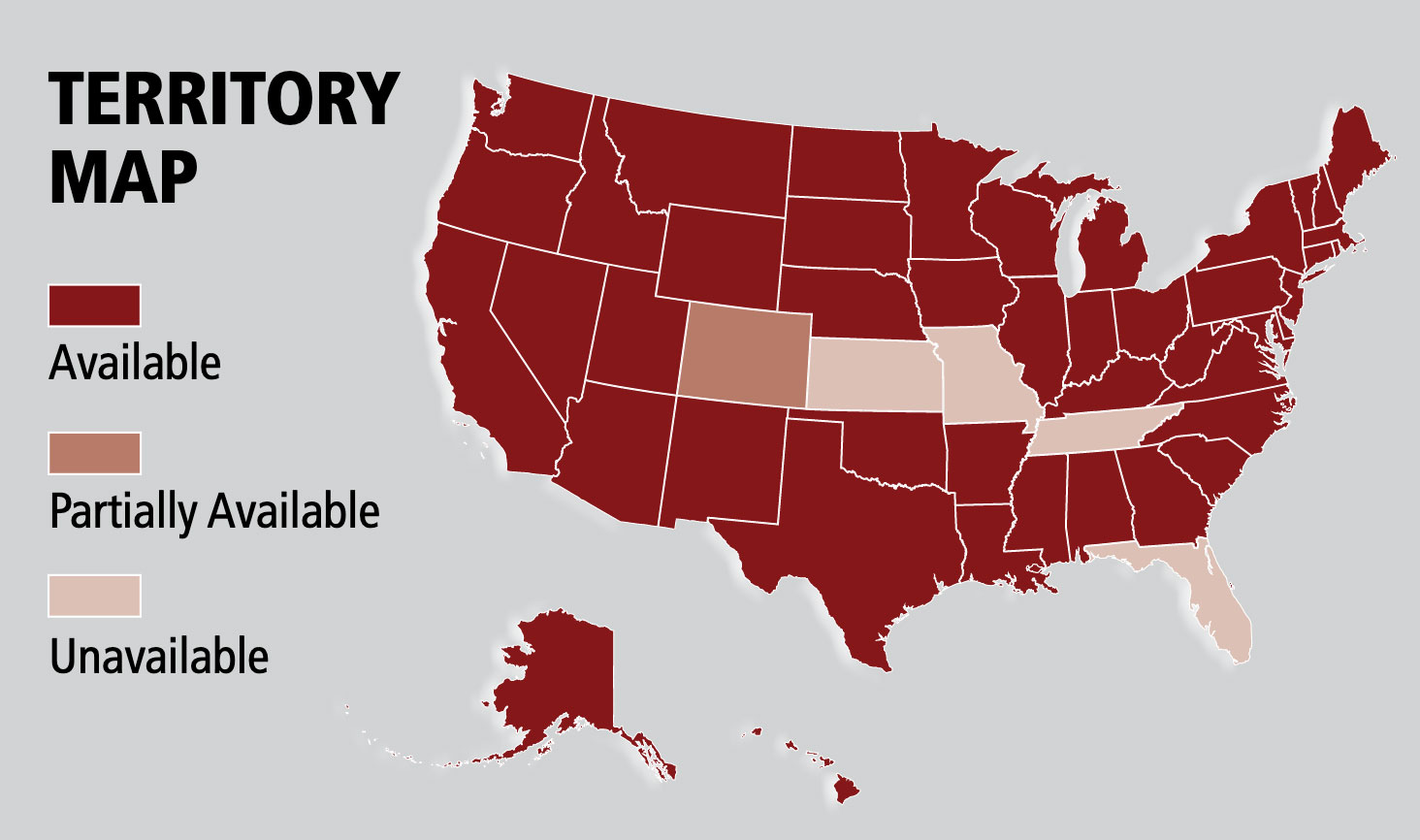

- Available in all 50 states

- Qualifications needed:

- Minimum of 1 year in the specific construction trade

- An active contractor license, if required by your state for that trade

- Maximum of 5 employees

- Maximum of 4 trades

- Maximum project size of $250,000

- Quick access and rapid approval, if eligible:

- Apply, pay, and print

For more information go to: www.GaslampGO.com

Call your Gaslamp agent or e-mail us at: Info@GaslampGO.com

Coverage Question

Even businesses that own fleets of autos sometimes use vehicles that do not belong to them. Often, a business asks an employee to run an errand or visit a customer or vendor using that employee’s car.The organization may become legally liable for anything an employee acting on its behalf does while behind the wheel. Lawsuits and accompanying legal costs may confront the business if they have an accident. Many business automobile insurance policies cover this situation, but they do not do so automatically.The standard Insurance Services Office Business Auto Policy uses numbered symbols to identify covered autos for each coverage the business has purchased. The policy provides liability coverage for non-owned autos only if symbols 1 or 9 are shown on the information page.

Symbol 1 – Means “Any auto.”

Symbol 9 – Means “Non-owned autos.”

The policy defines non-owned autos as autos the insured business does not own, lease, hire, rent or borrow and that are used in the business.

Non-Owned Autos

Non-owned insurance covers:

- The business’s employees,

- Partners (if the business is a partnership),

- Members (if it is a limited liability company), or

- Members of their households.

Coverage applies only if the vehicle is used in the business or in the policyholder’s personal affairs.

To illustrate, assume that a printing company needs an emergency replacement part that broke on one of its presses. One of the workers drives his personal vehicle to a parts warehouse 30 miles away. On his way back with the part, he collides with another car.

If the repair shop’s auto insurance policy’s information page has either symbol 1 or 9 for liability coverage, it will cover this accident.

It will pay for the shop’s legal defense costs and any resulting damages the shop is liable for, up to the amount of insurance purchased.

If the policy has another symbol, it will not cover an accident resulting from the use of the mechanic’s car.

Many types of businesses allow employees or partners to use their own vehicles for work purposes. Some examples:

- Restaurants that deliver.

- Businesses that do not provide company cars for salespersons.

- Architects, attorneys, engineers and other professionals who make site visits.

- Any organization that sends employees to offsite meetings, errands or professional conferences.

- Contractors who borrow trucks on job sites or who send employees to get tools.

- Any organization that sends employees to the bank or post office.

It is possible that the employee’s personal auto insurance policy may provide some coverage for you in case of an accident. But you should not assume that this is guaranteed.

Also, many individuals purchase the minimum amounts of insurance required by state law, so any coverage you share with the employee may be used up quickly and you would be liable for the rest.

It’s also possible that the employee’s personal insurer will subrogate with your insurer to recoup any claims payments if the accident happened in the course of their job.

The takeaway

Almost every company has a situation where it asks someone to use a personal vehicle for business.

If you are concerned that you may not be covered if an employee has an accident in their own car while on the clock, make sure the proper coverage is in place. An uninsured loss can be financially devastating, but is easily avoidable.

Workplace Injuries

Nearly 25% of all lost-time workers’ compensation claims are exaggerated, according to the National Insurance Crime Bureau.

While only a small percentage of workers’ comp claims are fraudulent, quite a few claims include employees staying away from work even after they’ve been cleared to return by their doctor and when they feel able to work. The term for this is malingering.

When injured workers malinger, the claim lasts longer than the medical disability. The employee has recovered enough to return to work, but has not. This can be due to employee intent, medical provider lack of knowledge about the job requirements, employer disinterest, or other reasons. As you can see, it’s not always the employee’s fault.

That said, some unscrupulous employees can take advantage of the system by:

- Staging accidents.

- Faking injuries.

- Claiming that an injury sustained while not at work occurred on the job.

- Inflating the degree of an injury to get more time off from work.

- Claiming that an old injury is a new work-related one.

- Pretending they are injured more seriously than they are.

- Staying on benefits and away from work even after the worker has healed (malingering).

20 Indicators of Possible Malingering or Fraud

Non-owned insurance covers:

- Tips from neighbors, relatives, friends or co-workers that a claimant is actually more active than alleged.

- The injury coincided with a company’s reduction of the workforce.

- Nurse case manager, doctor and therapist report a healthier and more active claimant than what is alleged.

- The lack of organic basis for the disability; most of the complaints and allegations are subjective.

- Premature or excessive demands for compensation.

- The claimant works in a seasonal occupation.

- The claimant often misses their therapy and/or doctor appointments.

- Having “dueling doctors,” with one physician stating that the claim-ant is disabled while another reports a completely different prognosis.

- No witnesses to the reported accident.

- The claim was reported after the claimant was let go or had resigned.

- The claimant had only been employed for a short while when the alleged accident occurred.

- The claimant is not home when you try to contact them.

- The claimant is disabled longer than is normally associated with the reported injury.

- The claimant has a history of workers’ comp claims or short-term employment.

- The claimant’s job performance has been below average, or they were disciplined at some point.

- The claimant’s Facebook or other social media page shows they are more active than they claim they can be.

- The claimant has financial problems.

- The course of treatment seems to be too much for the injury, like extensive treatment and testing for a minor injury.

- If it was a car accident, the damage to the vehicle is inconsistent with the claimed injuries.

- Documentation of treatment is suspect – for example, photocopies of bills, no record of dates of treatment, no itemization.

A word of warning

While some of these red flags don’t necessarily mean that there is fraud or malingering, if you do suspect it, you should contact the claims administrator handling your employee’s case.

If you can provide evidence to back up your suspicions, the insurance company may initiate an investigation that could include surveillance. All workers’ comp carriers are required to have fraud units, as per state regulations.

Construction Sector

You should never hire an unbonded subcontractor on a construction project, unless you want to put your organiza-tion at significant financial risk.

If the contractor you hired fails to perform their work as specified in the contract, without a performance bond you have no means of recovery from the company. Also, if the subcontractor fails to pay its subcontractors or suppliers, without a payment bond, your organization could be left holding the bag for the errant unbonded subcontractor.

Despite these risks, many contractors don’t require subcontractors to be bonded because they think bonding raises the cost of a project.

But any costs related to bonding are negligible compared to the problems you may encounter if you deal with unbonded subs.

The two most commonly used contract bonds for general con-tractors are payment and performance bonds.

- Performance bonds are meant to ensure that a contractor will perform and fulfill its contractual obligations in relation to the project owner or obligee.

- Payment bonds guarantee that the general contractor will pay subcontractors and materials suppliers whatever is owed them. This bond is also meant to protect the client from claims arising against them due to contractor negligence.

Payment bonds also cover all first-tier subcontractors and mate-rials suppliers, as well as second-tier subcontractors and suppliers to first-tier subcontractors on public construction projects.

In other words, all parties are well covered when a contractor has obtained payment and performance bonds.

General contractors are at risk if a subcontractor defaults on its obligations, or fails to pay its lower-tier subcontractors and suppliers. Even if you have a long-standing relationship with a subcontractor, you are still putting your organization at risk if you do business with them and they are unbonded.

Other Benefits

Higher standards – The chances of a subcontractor failing to finish its work, or failing to pay its own subs and supplier, are greatly reduced if they are carrying a bond.

That’s because a surety company must prequalify a company before they can secure a bond. To qualify, they have to go through a stringent process, including an examination and assessment of a company’s financial health and its ability to perform on projects.

The latter process is done by looking at prior projects the company has worked on and its experience in the industry.

The surety firm also assesses the subcontractor’s documentation and how the business operates.

In other words, the prequalification process weeds out subcontractors that are either not fit for a project, or may not have the intention to perform well on it. Sureties have no interest in underwriting bonds to unstable businesses, so they make sure to pick the most reliable subcontractors.

Reliability – Bonded companies are also more likely to work responsibly on your project due to their obligations to the principles of the project under the bond contract’s indemnification agreement.

A subcontractor bond will typically require that the business entity and its owners provide indemnity in the form of personal assets. Thus, subcontractors that are willing to put their personal assets at risk are more likely to see the job through and do it properly.

Good relationships – Most companies that are bonded and have been bonded on other projects will typically have a good relationship with their surety company.

Such partnerships are priceless in the inherently risky construction sector.

Companies that operate prudently and which foster and maintain good relationships with their surety companies, suppliers and other contractors are preferred business partners for all involved.

This newsletter is not intended to provide legal advice, but rather perspective on recent regulatory issues, trends and standards affecting insurance, workplace safety, risk management and employee benefits. Please consult your broker or legal counsel for further information on the topics covered herein.