While the number of COVID-19 workers’ compensation cases filed in California continues to grow, total workplace injury and illness claims in the state have fallen nearly 20% so far in 2020 compared to last year.

Through September, the state had recorded 47,412 COVID-19 workers’ compensation claims, accounting for 11.1% of all claims reported since the start of the year. During that same period, California workers filed 425,280 workers’ compensation claims, down 19% from the first nine months of 2019.

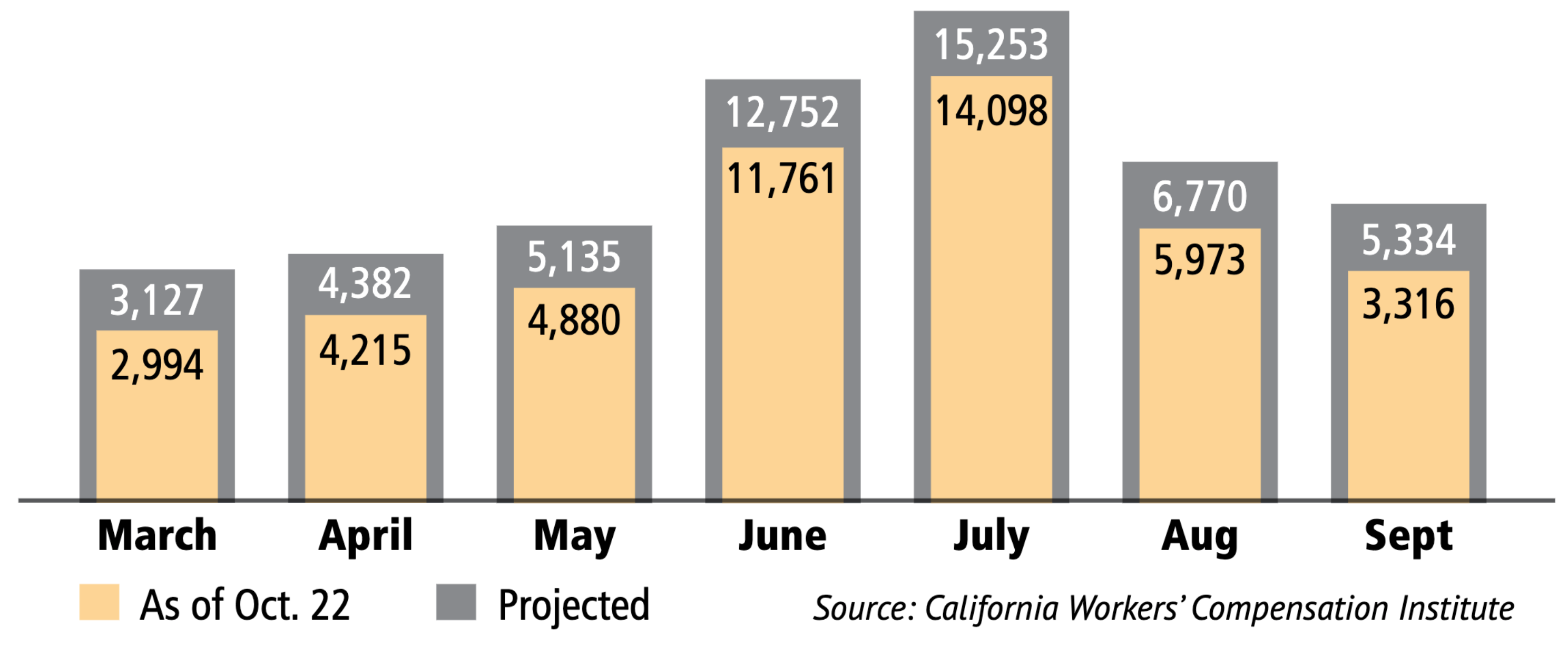

The first COVID-19 cases among California workers were filed in March. They peaked in July and started to decline in August, just when parts of the state started opening up on a partial basis.

California Coronavirus WC Claims

While it’s too early to tell if it’s a harbinger of things to come, the numbers are high enough that employers cannot let their guard down when it comes to preventing the spread of the coronavirus in their workplaces.

Who is filing claims?

The top five sectors reporting COVID-19 workers’ compensation claims during the first seven months of the year were:

- Health care: 16,889 claims (37%)

- Public safety/government: 6,902 claims (15%)

- Manufacturing: 3,759 claims (8.3%)

- Retail: 3,593 claims (7.9%)

- Transportation: 2,255 claims (5%)

Overall claims falling

Due to the severe economic slowdown brought on by the coronavirus pandemic that forced thousands of businesses to shut their doors or have their employees work from home, the number of overall workplace injuries has tumbled. There were a total of 425,280 workers’ compensation claims filed in California in the first nine months of the year, compared to 526,469 claims in the same period of 2019. The case load in September dropped 30% compared to September 2019. “That decline reflects both the sharp drop in employment, the high number of workers now working from home, and the pandemic-driven slowdown in economic activity in the state,” the California Workers’ Compensation Institute wrote in a report about the numbers.

Handling workers’ comp claims

A new law that took effect in September extends workers’ compensation benefits to California employees who contract COVID-19 while working outside of their homes.

To qualify for the presumption, all of the following conditions must be met:

- The worker must test positive for or be diagnosed with COVID-19 within 14 days after a day they worked at your jobsite at your direction.

- The day they worked at your jobsite was on or after June 6.

- The jobsite is not their home or residence.

- If your worker is diagnosed with COVID-19, the diagnosis was done by a medical doctor and confirmed by a positive test for COVID-19 within 30 days of the date of the diagnosis.

The takeaway

If you have an employee who is working on-site and who tests positive for COVID-19, you should let them know about their rights to file for workers’ compensation if they miss work and/or need treatment.

The state’s insurance commissioner has approved new rules that bar insurers from using any COVID-19 claims against your experience modifier (X-Mod), so it won’t hurt your workers’ compensation experience if an employee files a claim.

Risk Management

Have you ever sent an employee out to pick up needed supplies? Offered to buy lunch for the crew and asked an employee to pick it up?

Unless you only send employees who are insured to drive your company vehicles, you may be putting your business at risk.

Your business may also incur liability if you travel on company business and have an accident in a rented car while traveling to meet a client or for other business-related purposes.

If there is an accident that causes damage to a third party and the driver’s insurance doesn’t cover the full costs, your company may be sued to recover the excess amount.

Employees who use their personal cars are generally required by law to have insurance. But unless you hire them as drivers, you probably have no idea how much insurance coverage employees actually carry – or even if they have insurance at all.

If you’re traveling on company business in a rental car, you’re probably covered by your personal insurance or by a policy purchased through the rental agency.

But if you’re in an accident and cause damage that exceeds the amount of personal coverage you have, an attorney for the injured party would almost certainly seek damages from your company.

The solution

The good news is that there’s a simple and relatively inexpensive solution: a non-owned auto insurance policy. This type of policy protects your business if an employee gets in an accident and causes damage while running a company errand. It also protects your company if you cause damage in an accident while driving a rental car on company business.

Keep in mind that non-owned auto insurance generally doesn’t cover drivers – its purpose is to protect the organization. These policies do not generally function as primary insurance; they are designed for excess liability protection.

In other words, if your employee causes damage or injury in an accident while driving a personal car on company business, their insurance would generally pay first.

But if the liability exceeds the amount of the employee’s coverage, non-owned auto insurance would protect your business from being responsible for damage costs not covered by the employee’s coverage.

The bottom line

Liability claims caused by vehicular damage can run into the millions of dollars.

Your business could be at risk if an employee has an accident while traveling on company business.

Your company could also be at risk if you or an employee has an accident while driving a rental car on business. Non-owner auto insurance can provide peace of mind – and vital protection.

Construction

The average of a construction worker is now in the 40s. In the construction industry as a whole, baby boomers (people born between 1946 and 1964) represent 40% of the workforce, according to the Center for Construction Research and Training.

The nature of construction work presents many hazards for workers, many of which may not appear until late into a person’s career. Research suggests that long-term construction work impacts a worker’s musculoskeletal system.

Also, any time an older worker suffers a workplace injury, they are more likely to be out of commission – and the road to recovery is longer.

Because of the physical demands of the work, construction workers who are employed have to be healthier than the general population, but the same physical demands cause workers with injuries or illness to leave the industry.

We know that 10% of construction workers do not return to work after an injury, and that construction workers with a musculoskeletal disorder (MSD), lung disease or injury are more likely to retire on disability than workers with the same conditions in less physically demanding work.

Compared to office workers, construction workers are also less likely to have health insurance and have an increased likelihood of developing a chronic disease as they age. Their odds also increase for developing lung disease, stroke, back problems and arthritis.

Risk factors for older workers

Lower-back injuries are a common injury experienced among construction workers. Also, as people age, they naturally lose strength and muscular endurance, which could have an effect on their ability to carry heavy loads. They may also lack the flexibility of younger workers and experience trouble working in awkward positions, making them more prone to a workplace injury.

Physical workload is an important determinant of work ability among construction workers, and in turn work ability is highly predictive of disability among such workers. A construction worker between the ages of 45 and 54 with a low WAI and severe low-back pain has a 40-fold increased probability of disability retirement compared to a construction worker without those risk factors.

And if they are injured, it will take someone older than 40 twice as long to recover from a typical injury.

A study of U.S. construction roofers found that workers over 55 had lower physical functioning and were more likely to have both a chronic medical condition and an MSD.

The study found that older age, reduced physical function, and lack of job accommodation among these roofers were each predictive of early retirement.

It also found that construction roofers who had received job accommodation for an MSD or a medical condition were four times less likely to retire compared to workers with similar medical status but without accommodation.

Some form of job accommodation was offered to more than 30% of the workers in the study, and many of the accommodations were relatively simple, such as allowing more time to accomplish a task or changing the work schedule. Few employers provided new tools or equipment.

Using the proper tools and work practices is important. You should also recognize the importance of job rotation among workers to help prevent repetitive-motion injuries.

Shifting focus from hazardous to safe work practices will help reduce injuries and keep older and more experienced employees safe and healthy on the job.

Industrial Injuries

Employees are your most valuable assets, but many businesses overlook the importance of having a workplace safety program in place to protect them. Loss control is about employers caring for their workers’ safety. Successful loss control programs are means of reducing injuries and the severity of a potential accident.

If you want to reduce the costs and risks associated with workplace injuries and illnesses, you need to address safety and health right along with production. A plan must be written that includes procedures and is put into practice. Implementing an Injury and Illness Prevention Program (IIPP) will help you do this.

The IIPP will identify what has to be done to promote the safety and health of your employees, and the safety of your worksite. Taking an approach to loss control will make the workplace safe, decrease workers’ compensation and overtime costs, reduce turnover rates, and minimize the risk of Occupational Safety and Health Administration fines – all of which in turn will increase productivity and profits.

Essential IIPP Elements

- Assignment of responsibility

- Communications

- Compliance

- Inspections

- Investigations

- Correcting unsafe conditions

- Training

- Record-keeping

Strong Documentation

Records are an important part of your safety plans. The following records should be maintained:

- Training

- Employee injuries

- Accident/injury investigations

- Inspection records/corrections

- OSHA 300 logs (where required)

- Job analysis

- Safety meetings

- Equipment and vehicle inspections

- CPR/first aid training

- DMV driving records

Loss control starts with an authentic commitment from management. Employers should also ensure that supervisors, managers and employees are all on board and, together, the two collaborative teams will achieve success.

Hazard assessment, evaluation, action-planning, problem-solving, implementation, record-keeping and documentation are the steps for a successful loss control plan.

Open communication with employees is important to facilitate a successful loss control program. Employee cooperation is connected to everyone understanding what the program is all about, why it is important to them and how it personally affects them.

Consider different channels via which your workforce can be informed, including meetings, e-mails, newsletters or check inserts. Training is an important aspect of your program to ensure everyone has a good understanding of workplace safety.

The takeaway

Remember to update and maintain all your programs at least once a year and/or if there are any changes.

If you are ready to make the commitment of reducing injuries and illnesses and managing claims, you can expect your costs to go down and your profits to go up.

This newsletter is not intended to provide legal advice, but rather perspective on recent regulatory issues, trends and standards affecting insurance, workplace safety, risk management and employee benefits. Please consult your broker or legal counsel for further information on the topics covered herein.